China's second largest mobile and online travel platform, Qunar announced its unaudited financial results for the second quarter ended June 30, 2015.

Highlights for Q2 2015

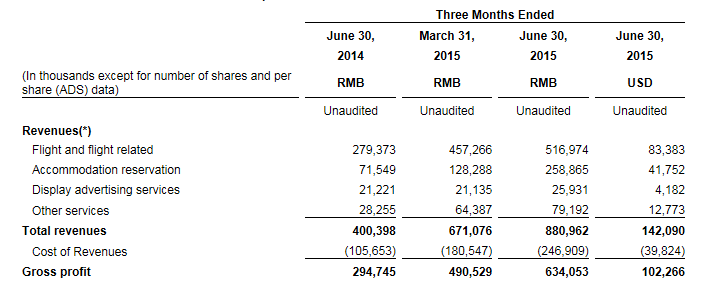

- Total revenues for Q2 2015 were RMB881.0 million (US$142.1 million), an increase of 120.0% y-o-y.

- Gross profit for Q2 2015 were RMB634.1 million (US$102.3 million), an increase of 115.1% y-o-y.

- Mobile revenues for Q2 2015 were RMB600.1 million (US$96.8 million), an increase of 321.7% y-o-y, representing 68.1% of total revenues, compared to 35.5% in the corresponding period of 2014.

- Total Estimated Flight Ticket volume (TEFT) and Total Estimated Hotel Room-night volume (TEHR) for Q2 2015 were 28.1 million and 17.8 million, respectively, an increase of 46.9% and 145.2% y-o-y.

"Qunar's y-o-y revenue growth reached 120% in Q2, the fifth consecutive quarter of over 100% growth. Momentum continued to be very strong across business lines," said Chenchao (CC) Zhuang, chief executive officer and co-founder of Qunar. "The solid results reflect the ongoing progress of our key initiatives, most notably in the areas of growing our mobile user base and expanding our hotel direct business, with mobile revenues up 322% year-on-year and hotel volume up 145% year-on-year in Q2."

"We are proud of the strong returns generated from our investment in mobile and in building our hotel supply chain, and are particularly encouraged by the results of the offline campaign we started in Q2," said Yilu Zhao, chief financial officer of Qunar. "Our Q2 results exceeded previous guidance for both revenue and operating margin. We will continue to execute on our ROI-driven growth strategy and look forward to further fortifying Qunar's position as the leading mobile and online travel platform in China."

Q2 2015 revenue breakdown

Other developments in Q2 2015

Qunar entered into a US$300 million revolving credit facility agreement with Baidu on February 27, 2014 which it will repay either by cash or by our shares. Qunar drew down another RMB507 million and RMB627 million from Baidu on March 12 and May 4 2015 respectively and will use the funds for its operational and investment needs.

Qunar issued a 2% senior unsecured convertible notes with a conversion price of $55 per ADS in the amount of US$500 million on June 17 2015. Qunar also offered 6,842,106 American Depositary Shares through a public offering priced at US$47.50 per ADS on June 5, 2015.

As of June 30, 2015, Qunar had 224,299,179 Class A ordinary shares and 168,520,421 Class B ordinary shares outstanding.

Qunar filed a complaint with the PRC Ministry of Commerce (MOC) against its arch rival and China’s top OTA Ctrip in August, accusing the latter of breaching the PRC’s Anti-Monopoly Law and the State’s declaration threshold guidelines in its acquisition of eLong. The MOC quickly responded by arranging a meeting with Ctrip and related parties to inquire the case against Ctrip under anti-monopoly and fair trade rule.

Ctrip denies it has a monopoly and says Ctrip and eLong only take up 5% share of China’s huge domestic travel market it also dismisses Qunar’s complaint and acquisitions as “irrational behavior coming from a company cracking under pressure”.

Ctrip holds the top position in China’s online travel market but Qunar has been closing in on the profitable hotel booking market over the last two years after gaining a footing in air ticket bookings so Ctrip’s eLong acquisition has put it on a collision course with the aggressively expanding Qunar over the hotel bookings segment.

Business Outlook

For the third quarter of 2015, Qunar expects year-on-year revenue growth in the estimated range of 140% to 145% and year-on-year growth of gross profit in the estimated range of 105% to 110%.