ChinaTravelNews, Nicole Sy - Harvard MBA student, Alex Lim, 26, flew from Boston to Beijing in March this year without any stopovers—a first for many travelers with the opening of Boston’s first-ever direct China flight. “It was definitely one of the better experiences I’ve had on a Chinese airline,” he says of the flight operated by Hainan Airlines.

Hainan Airlines is part of the Top 100 Most Valuable Chinese Brands 2015 as analyzed by BrandZ, one of the world’s top brand valuation firms. Their definitive brand valuation methodology combines “extensive and on-going consumer research with rigorous financial analysis.”

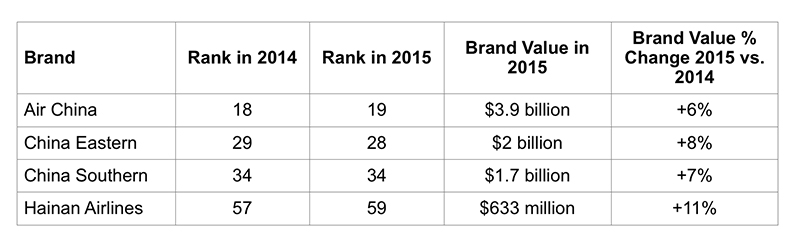

Part of a three-part special series, ChinaTravelNews takes a look at the Travel industry brands that made the list. Part 1 takes a look at airlines, seeing as four of China’s largest carriers have made the list. Air China ranks the highest at 19, followed by China Eastern at 28, China Southern at 34, and Hainan Airlines at 59.

“Airlines enjoyed healthy growth, driven by leisure travel demand, particularly to overseas destinations, and government investment in airport construction,” according to the report. The category grew 7 percent to reach a total of $8.2 billion from its value year on year from 2013 to 2014.

Growth strategies came from both ends of the spectrum, targeting both improved customer experiences for premium passengers and introducing low-cost carriers for price-sensitive travelers. However airline sales were impacted by recent government austerity campaigns and high-speed rail competition.

According to the Civil Aviation Administration of China’s 12th Five-Year Plan from 2011 to 2015, the country’s airline industry had planned on 13 percent annual growth. The industry looks to be keeping up with the plan with China’s three State-Owned Enterprises (SOE), and earliest airlines, Air China, China Eastern Airlines and China Southern Airlines, dominating the market in present day.

At the top of the airline category, as the 19th most valuable Chinese brand 2015, Air China’s brand worth is valued at $3.9 billion. It grew 6 percent from 2014, when it also claimed a spot on the list. This time around, Air China aimed to enhance customer experience, providing improvements for premium travelers, upgrading food quality, providing Wi-Fi on certain routes, and services before, during and after flying.

The carrier also increased its destinations to North America and Europe from its hubs in Beijing, Shanghai, and Chengdu, and increased services to lower-tiered Chinese cities.

China Eastern at China’s 28th most valued brand is worth $2 billion and grew 8 percent from 2014 to this year. While Air China targeted premium experiences, China Eastern forayed into the underserved low-cost air travel market by converting one of its wholly owned subsidiaries China United into a budget carrier.

China Eastern’s domestic routes were affected by the slowing Chinese economy and greater rail competition, but increased its services to Japan, Korea and North America, adding a direct flight from its Shanghai headquarters to Toronto, Canada mid-2014. The direct flight shaves 5 hours from flying time at 14 hours instead of 19 hours, when aircraft had to make a stopover at Vancouver, Canada. Today, China Eastern competes with Air China and Air Canada offering non-stop flights from Shanghai to Toronto.

Guangzhou-based China Southern’s brand is valued at $1.7 billion, with a year-on-year change of 7 percent. At 34th place, it also targeted premium travelers with improved in-flight entertainment, food and customer service, though was likewise affected by a slower Chinese economy and rail competition. Their strategy involves investing in the southern Chinese city of Guangzhou, and building as a hub to connect traffic between the Australian continent to Europe.

Hainan Airlines is the youngest, and only market-driven airline of the four companies included in the top 100 most valued China brands list. With a brand valuation of $633 million, it is less than half of China Southern’s and a sixth of Air China’s brand value, though it has grown the most of the four airlines with 11 percent growth.

In June 2014, it launched its direct Boston-Beijing flight, introducing a service to Boston, the sixth largest US destination from China, and the last large US city without a direct service to the country. The flight targets the city’s many universities and colleges with Chinese students.

“About 10,000 Chinese students study here,” Joel Chusid, US executive director for Hainan Airlines, said in a Forbes interview. “The educational institutions are a big draw, and they generate a tremendous amount of additional traffic. The families come over, the professors travel, and there are group trips. You might think the student travel is all low-yield, but many of them are well heeled and a percentage are traveling in premium class.”

Premiumization, according to BrandZ, was a key theme to the airlines that made it to the top 100 Chinese brands. Premiumization in China is the ability of Chinese consumers to allow a brand to charge more, justifying a higher cost for their product or services.

“Air China upgraded service for high-paying passengers as part of an effort to distinguish the brand from competitors. China Southern Airlines also upgraded services for premium passengers. Hainan Airlines introduced free private limo service for business class passengers in Seattle, Chicago and Boston,” the report highlights.

“As the Chinese middle class continues to grow, we are seeing a fundamental shift in consumers’ “quality consciousness”,” says Jeff McFarland, Director of Strategy, Greater China for Landor Associates. That means if consumers believe the product or service is of a better quality, they are more willing to spend more for it.

China Airlines, China Eastern and China Southern have also made the top 20 most trusted Chinese brands in BrandZ’s extensive annual report.

At an average level of 100 for BrandZ’s Trust Index, Air China scored 140 points, as the second-most trusted Chinese brand this year. China Eastern follows with 118 points at 18th, with China Southern close behind with 116 points at 20th.

The report highlights product safety as the cornerstone of brand trust, with 43 percent of consumers listing Safety as a characteristic indicative of being trustworthy. The Top 100 report writes, “Consumers overwhelmingly agree that the most important actions a brand can take to win trust are to use safe raw materials and ensure that products and services meet high safety and quality standards.”

All four of the airlines made the list last year in BrandZ’s 2014 Top 100, and maintained relatively similar positions. Air China slipped one rank, while Hainan Airlines fell two spots down. China Eastern climbed a rank higher, while China Southern maintained its position. The Airlines category grew 9 percent from its value year on year from 2012 to 2013. Prior to 2014, BrandZ only ranked China’s Top 50 most valuable brands.

As for next year’s performance, the recently announced 10-year visas between China and the US and Canada have already increasing the number of passengers and flights between China and North America. That’s in addition to the country’s new 72-hour visa exemption policy for Beijing, Shanghai, Guangzhou and Chengdu for travelers from several countries.

There’s also the mandate set forward by the State-owned Assets Supervision and Administration Commission (SASAC) for Chinese SOEs to seek profitability and clean up their act on internal corruption. SASAC will offer no pay raises for underperforming SOEs like Air China, China Eastern and China Southern Airlines. The investigations for corruption in SOEs have already begun, with the firing of China Southern’s Chief Financial Officer, Xu Jiebo and three other top executives in the company, for suspected graft in January this year.

SASAC has also reportedly ordered the SOEs to charge zero percent sales commissions and increase their direct sales, with China Southern Airlines first taking the leap. Air China and China Eastern Airlines followed this move very quickly.

A China Southern executive, who requested anonymity due to the sensitivity of the issue, confirmed SASAC’s aggressive goals for the SOEs to Charlie Li, CEO of Chinatravelnews. Calling it the “Double 50”, China’s biggest three airlines must achieve 50 percent of direct sales and cut external commissions by 50 percent, both in three years time.

Direct sales channels consist of their own sales counters, official websites and the like. The airlines will have to redesign their sales strategies to not rely on agents, but by reducing agent commission expenses, the SOE carriers will reportedly save billions in sales expenses.

The forecast looks like blue skies for Chinese airlines, as they have plenty of room to grow… whether they want to or not.

Look out for Part 2: Hotels in China and Part 3: Travel Agencies, ChinaTravel News’ three-part series of China’s most valuable brands in the industry.