ChinaTravelNews, Ritesh Gupta – Chinese online travel company Tuniu has asserted that its rising prowess on the procurement side is paving for an attractive proposition in the self-guided tour packages segment.

This business is going to make meaningful contribution, with better monetization resulting from dynamically bundling together of air ticket, hotel and other travel products. Tuniu is also optimistic about the self-guided tour segment’s take rate going up in the future.

Even as OTAs have embraced open-source procurement strategy, it is vital that they make the most of direct association with travel suppliers. If bulk buying is resulting in sizable business volume for both the parties, then it lends a solid dimension to an intermediary’s procurement pricing and overall product offering. At the end of last year, the company had a product procurement team of over 1,250 staff. This team focuses on strengthening with travel suppliers. In the last quarter of 2015, Tuniu’s direct procurement products had reached over 30% of their total gross merchandise value. The company works with over 11,000 travel suppliers.

The company’s core strength is in overseas leisure travel products and services, which contributed over 65% of gross bookings in 2015. GMV contribution from the long haul trip is going down as a percentage of total GMV.

It needs to be highlighted that revenues from organized tours have hovered between 96-97% over the last three years.

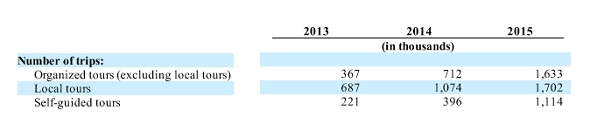

In the first three months of this year, total number of trips continues to rapidly grow at 80.2% year-over-year.

Overall, net revenues in Q1 went up by 62.8%.

Group buying resulting in “favourable pricing”

Conor Yang, Tuniu’s Chief Financial Officer highlighted that direct procurement remains a strong link, as travel suppliers tend to be same for self-guided tours, too. “…we have been working with many suppliers for long time and we speak volume,” he said during the company’s recently held Q1 2016 earnings call.

“…important thing is that on the organized tour (side), we typically purchase group tickets from airline companies, as well as (on the) hotel side. (This means) we have a purchase like a group rate rather than the individual rate. So these two rates are different…when an airline, for example, when they sell individual tickets to OTA (they are sold) at a (relatively) higher price versus they sell a “group ticket” to travel agencies like us,” said Yang, referring to the way Tuniu is currently is doing bulk sourcing of products from suppliers.

Yang referred to Capital Airlines, an entity which is a part of the Hainan Airlines Group. “We (have) already started using their group ticket airfare to supply our self-guided tours customers,” said Yang. “...so that they can use that ticket to combine as a package with hotel, making packages for self-guided tours. Since it’s a package, therefore, we will not expose the group ticket airfare towards their channel price.” From reach perspective, since the company’s sales network has forayed into third-tier, fourth-tier, and fifth-tier cities, the existing base, too, would be given an option to avail self-guided tour package as when the market is ready.

He went on to add that the self-guided tours product gains further ground with Tuniu’s ability to dynamically bundle air ticket and hotel together with an extensive array of localized resources such as destination-based services and tours in self-guided tours. Typically, such tours feature flights and hotel bookings and other optional add-ons, such as airport pick-ups. These products are offered at attractive prices compared to booking each travel product separately.

The company has specialists, who play a vital in role in planning of self-guided tours.

Tuniu’s group travel tour advisors work with travel suppliers and travellers to design travel products and itineraries that meet customers’ unique needs.

Last year, Tuniu’s revenues from self-guided tours increased by 108.5% from RMB93.1 million to RMB194.2 million in 2014. And in 2014, the revenues from self-guided tours had increased by 90.4% when compared with 2013.

Diversification

Tuniu has been working on strategic initiatives since the commencement of this year to enhance its hotel booking, themed tours, and air ticketing business units.

Importantly, as Donald Yu, Tuniu’s co-founder, Chairman and CEO mentioned, additional product categories are “reaching scale” and delivering operational synergy. In Q1, GMV from air ticketing grew more than 30 times y-o-y and hotel grew more than seven times.

In terms of progress, “other revenue” grew 506.9% year-over-year during Q1, indicating diversification. The top contributor in this category at this juncture is service fees received from insurance companies.

Other sources include service fees for financial services, commission fees for hotel reservation and air-ticketing, and revenues from tourist attraction tickets.

The company has worked on distribution diversification, a move signalled by the introduction of procure rate online B2B wholesaling channel. Wholesaling is expanding reach to lower tier cities, for instance, distributing product to local travel agencies in fifth or sixth tier cities.

Yang mentioned that in addition to strong distribution network, the company is differentiating their offering by being “the only one that’s 100% focused on leisure travel”.

“…we continue to focus on leisure travel, we have gained number one position on the online leisure travel first. And now we’re expanding to even the flight booking, hotel booking, but it’s all more focused on the leisure travel destinations, the leisure travel by route,” he said.

So if on one hand, the company is focused on being a strong distribution arm for suppliers, on the other it is leveraging its reach (penetrating into lower tier cities as well), ability to step up loyalty (returning customer contributed 43.6% of gross booking during in Q1, was around 30% same time last year), driving operational synergies, as well as facilitating transactions via mobile (80% of total orders in Q1 from mobile) in an increasingly cashless society to scale up its business further.